Benefits & Employee Relations

Page Navigation

-

Retirement Transition Option

In the Spring of 2022, the Knox County Board of Education voted to change our new hires/rehires retirement to the Tennessee Consolidated Retirement System (TCRS) Hybrid Plan. All new hires/rehires with a start date of July 1, 2022 or after began with the TCRS Hybrid Plan as their retirement. Any employee with a start date prior to July 1, 2022 has the option to change from the Knox County Asset Accumulation Plan to the TCRS Hybrid Plan. A form will need to be completed for all classified employees notating if they would like to stay with the Asset Accumulation Plan or move to the TCRS Hybrid Plan. Here we have provided resources for our employees to help them make an informed decision. For questions, please feel free to contact our office.

If choosing to change to the TCRS Hybrid Plan, for retirement purposes, your years of service with KCS will not transfer; however, do not let this fact alone make your decision to stay. In some situations, you may still want to consider moving.

If you choose to move, you may leave your current retirement accounts as they are with the Knox County Asset plan. It will continue to accrue gains and losses, but no new contributions will be made.

We will be sending an email with instructions on how to choose if you are staying or wish to move by the end of November. All decisions must be made by January 31, 2023. The new retirement will take effect July 1, 2023.

-

Current Plan Details

Plan Name: Knox County Asset Accumulation PlanType of Retirement Account: Defined Contribution (401a)

Defined Contribution

- Contributions are invested on member’s behalf

- Vested after 5 years of service

- Account balance is based on investment gains and losses

- Upon retirement, no guaranteed lifetime benefits, members will need to pace their withdrawals to the funds last through retirement

Mandatory Contributions: Employee 6% per check and employer 6% per checkAdditional Investment Opportunities:

Voluntary 457 Account

- Employee may contribute additional percentage of each check into a 457 account

- Additional EMPLOYER match option for participants based on years of service

- After 5 years of service – additional 2% match

- After 10 years of service – additional 4% match

- After 15 years of service – additional 6 % match

- All matches are in addition to the mandatory deductions

- Employees must contribute at least the match percentage or more in order to be eligible for the match.

MERP (Medical Expense Retirement Plan)- Plan helps pay for medical expenses after retirement (i.e. medical/dental premiums, out of pocket medical expenses)

- Minimum contribution - $8.00 per bi-weekly pay period, $17.34 per monthly period

- Employer will match 50% of employee contributions, with an annual maximum employer contribution of $416

-

New Plan Details

Plan Name: TCRS (TN Consolidated Retirement Plan) Hybrid PlanType of Retirement Account: Defined Contribution (401k) AND Defined Benefit

Defined Contribution

- Contributions are invested on member’s behalf

- Vested immediately upon enrollment

- Account balance is based on investment gains and losses

- Upon retirement, no guaranteed lifetime benefits, members will need to pace their withdrawals to the funds last through retirement

Mandatory Contributions: Employee (recommended) 2% per check and Employer 5% per checkDefined Benefit

- Vested after 5 years of service

- Vested member eligible to receive lifetime monthly retirement benefit

Mandatory Contribution: Employee 5% per check and Employer 4% per checkTotal Contributions – Employee 5%, with optional additional percentage and Employer 9%

Additional Investment Opportunities: None

-

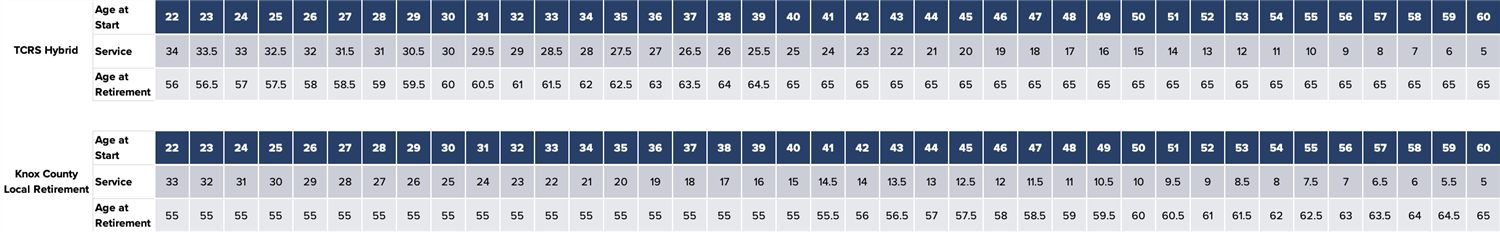

Retirement Eligibility

- "Age at Start" for TCRS is 7-1-2023 no matter how many years you may have at KCS; "Service" only counts beginning 7-1-2023

- "Age at Start" for KCLR is your actual KCLR start date, and "Service" counts all years you have with KCS

- If you opt into TCRS, you retain your KCAAP balance, plus any investment gains or losses, but no additional ER or EE contributions beginning 7-1-2023

-

Social Security Estimate and Income Replacement Factor

-

* Numbers based on Social Security Estimator

* Check your ssa.gov statement for more specific numbers